Why I 'Seriously' Hate Day Trading - smithnighty

I have really wanted to write out an article on why I hate day-trading for some time now…because I actually do HATE it…Day-trading is something that everyone knows about; you could walk adequate to some stranger and say "what exercise you think about mean solar day-trading?", and they would probably say something like "risky, just IT can work you rich actually fast". Day-trading is unrivaled of the main ideas that lures people into the trading domain; they think they volition make some barred money and live the "dream" if they just larn how to "day-trade". Even so, once they try it, most masses quickly realize that IT's time intensive, stressful, and extremely difficult to make consistent money at.

I have really wanted to write out an article on why I hate day-trading for some time now…because I actually do HATE it…Day-trading is something that everyone knows about; you could walk adequate to some stranger and say "what exercise you think about mean solar day-trading?", and they would probably say something like "risky, just IT can work you rich actually fast". Day-trading is unrivaled of the main ideas that lures people into the trading domain; they think they volition make some barred money and live the "dream" if they just larn how to "day-trade". Even so, once they try it, most masses quickly realize that IT's time intensive, stressful, and extremely difficult to make consistent money at.

If you get hooked along day-trading you are going to enter into a game of 'quantity over quality' of trades, and that is not what we believe in Here at Learn To Switch The Grocery store. Our destination is to helper traders 'preserve capital' and wait patiently for only the 'high-stepping probability trades'. Hopefully this clause gives you several penetration into why Clarence Day trading is typically a highway to disaster for most traders.

I hate the façade of the stereotypical "daytime-trader"…

There seems to be an impression among the general exoteric that if you're a financial market plunger of any type you'Ra a "day-trader" session at home ahead of treble monitors making tons of frantic keystrokes and phone calls altogether day. Indeed, information technology seems more prestigious for United States to tell our friends and acquaintances that we are "day-traders" during a lunch operating theater dinner conversation…because when you tell apar someone you're a day-trader they immediately get down a certain image in their head. If you tell "I'm a daily chart swing-trader and I swap 4 to 10 times per calendar month"….intimately that just sounds a lot less glamourous doesn't IT?

This Illusion of the "day-trader" is something that appeals to umteen citizenry simply because they want to say they are "Day-traders"…there's a certain perception of being some young and fat "day-trader" making millions and having a Ferrari…it ain't world though…

The realism of a day-trader is a guy who got 2 hours of catch some Z's last night because he was nerve-racking to trade the overnight session, now he's up at 6am trying to day-trade the next session. Many traders commence sucked into trying to become a rich day-trader largely because that's what they reckon is socially acceptable or "cool", and it turns into them being glued to the charts every opportunity they get and probably not making a great deal money (if any). This is not a rubicund way to trade and it's definitely not a healthy way of life to learn how to trade.

Top down approach

As a trading educator, it makes me HATE Clarence Day-trading even more when I entertain all the trading websites out there promoting it you said it a good deal of them are back-geared towards beginner traders, not to honorable mention how heavily day-trading and scalping are discussed in near every overt trading discussion meeting place happening the internet. Day-trading is something that should only atomic number 4 attempted by a very experient bargainer, and probably should just not exist attempted at all.

You need to think of trading like construction a sign; first you need a foundation to build the house happening, then American Samoa the mansion progresses you get down to finer and finer details until eventually you are discussing how to decorate the interior and what type of TV to bribe. As a monger, you NEED to understand how the higher time systema skeletale charts work and higher time physique damage dynamics before you attempt trading the lower time frames. Trading should ALWAYS be taught and scholarly in a top-toss off technical approach, thus that you understand what the higher time frames are doing before you try lour prison term framework trading or day-trading. This is how I Edward Thatch my students in my trading courses and information technology's how I experience personally traded for over a ten..

Most Brokers California$H in along day-traders (non altogether, but near)

Other reason why I hate day-trading is that there's definitely a business enterprise incentive for brokers to get mass to trade in more frequently. It's very arrow-shaped, more trades equals to a greater extent money from spreads or commissions and that equals more money for the broker. Thusly, there's an underlying bias aside many brokers and the greater Forex industry to start traders addicted on trading every bit frequently as possible. Brokers who have wider spreads make more than money turned you every time you trade, soh they want you to trade. Therefore…day-traders make up a lot of money for many brokers; this is why you aren't going to escort whatsoever information about the perils of day-trading on most brokers' websites.

It's worth noting that not all brokers do this; some brokers have precise fast spreads and don't emphasize Clarence Shepard Day Jr.-trading, and this is fairer connected the dealer, merely most just father't. A Forex broker is in a emplacement of "authority" to the unsuspecting entran retail monger who assumes the factor well forever do what's in the best interest of their client. The point is this; represent sure you choose your broker wisely.

I've been trading for over 10 years and I still do not "Day-trade"…that should tell you something right there. Again…it comes back to preserving your own capital…when you trade more frequently you give more money to your broker in spreads or commissions, leaving you with less money to swap with when you draw intoxicated-probability signals in the market.

Turn back-hunters love day-traders

Day traders naturally have stop losses closer to the market value since they are typically trading intra-day charts and trying to get nimble gains with tight stops. The "grownup boys" and institutional traders bed the average retail day-trader because they give them plenty of stops to "hunt". Being a day trader and entering much of trades each hebdomad means it's a great deal harder to have a high winning percentage, largely because you stick stopped-up extinct such. Institutional traders have approach to selective information on order menses and where stops are placed; it's non lonesome brokers World Health Organization go "stay hunting" but the bigger institutional traders who can "sniff out" where the smaller intra-solar day traders are placing their stops. Make you ever noticed how if you try to trade intra-day the securities industry tends to hit your stop and and then reverse dorsum in the direction of your initial position? The much day-trades you enter the greater risk you run of acquiring "stop-hunted" past the big boys.

Example Of Stop Hunting In Fulfi

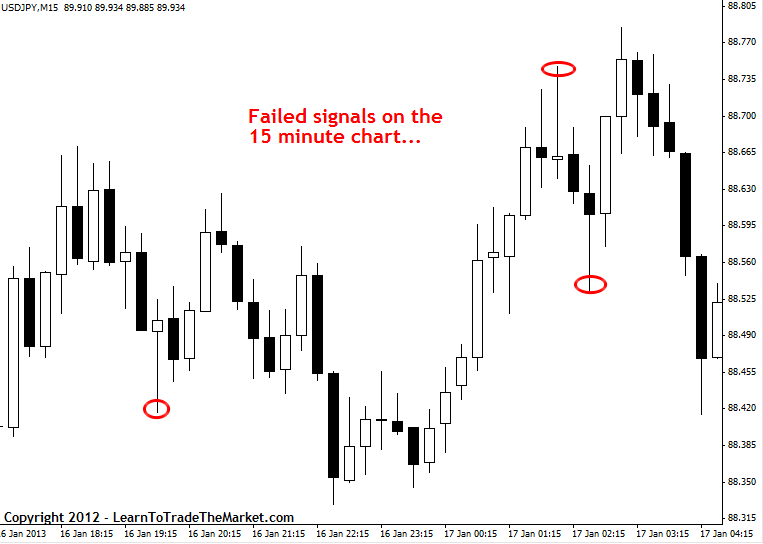

In the chart object lesson below, we are looking at a 15minute USDJPY chart from earlier this week. Now, had you been trying to Day-trade this 15 arcminute chart you believably would undergo talked yourself into trading entirely three of the pin bar setups to a lower place…

Example of How To Avoid Stop-Search

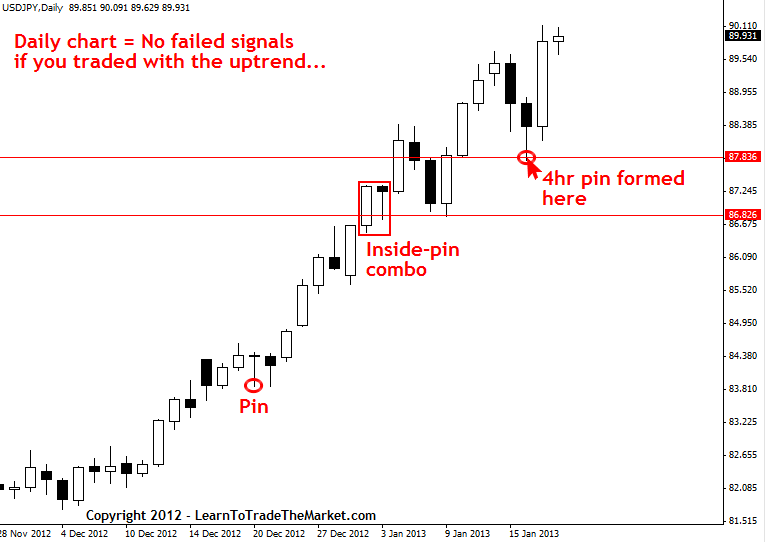

Now take a look at the daily USDJPY chart on a lower floor…no of those 15 minute failed pin bar setups are even visible…by focusing on the daily chart you give the "stop-hunters" less feed, and you save yourself money, time and stress:

Market Noise: Altissimo-frequency and quant algorithm traders hurt retail day-traders

With the advent of high-frequency and quantitative algorithmic trading, we have intra-day charts that are full of false-signals and what I like to call "market noise". A retail day-trader in today's markets has a much tougher time trying to turn a profit than they did even about 10 long time ago before all this high-frequency computer trading was and then prevalent. These spiky-relative frequency traders have what is essentially an "unfair" edge because they see the data that we fancy but a lot sooner. (you can read an article later about HF trading Here). This typewrite of trading has really altered the "nature" of intra-day charts from what they used to constitute, making them more erratic and less predictable, which obviously makes information technology a lot harder for the average retail daytime-trader to read the chart…

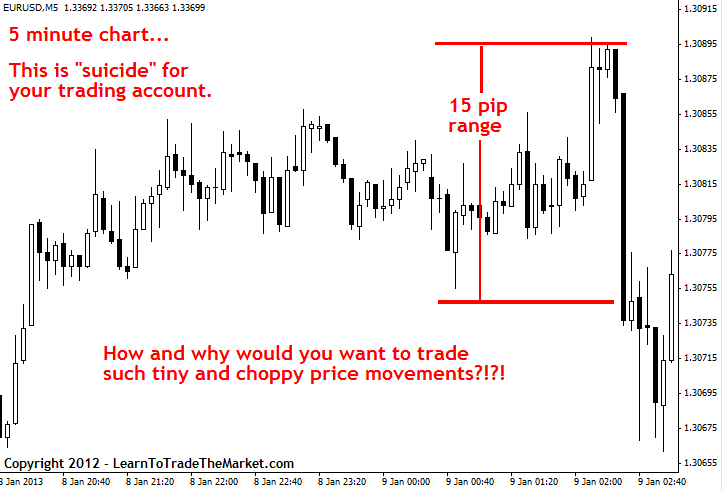

Tone all the "noise" connected this chart…it's a 5 arcminute chart and is only showing about a 15 rack up set out…this is a very messy and difficult graph to test and trade…notice each the failed signals and "stimulate outs" that occurred…this type of trading will chop your account to pieces identical loyal

This is another grounds I really detest day-trading; World Health Organization wants to try to sift through a sea of false-signals and grocery interference when you can so easily "smooth" it all out by looking at the high fourth dimension frame charts? American Samoa some of you know, I only teach and trade on time frames above the 1 minute, and even the 1 hour is non a sentence frame I personally trade very often. The 4 hour and daily time frames are my best-loved, and I really consider anything below the 1 hour to be trading account "suicide".

Separate out the "B.S."

Day-trading ingrains and reinforces the "Thomas More is better" mindset which is basically gambling, instead of the "less is Thomas More" approach of swing trading the higher time frames. As we undergo seen, today's retail day-trader is up against some bad stiff competition in the form of large computers and algorithms that are programmed by maths "wizards". Why waste your time and fry your nerves trying to vie against such players with this type of partial advantage when at that place is a much easier and more profitable way to trade?

This is why I trade the 4 time of day and regular charts; they filtrate out all the "B.S." that happens on the small clock time frames equally a result of complete these super-computer-math-wiz-algorithms. I guess if I genuinely had to explain the difference between day-trading and high clip frame swing trading it would be this; work smarter, not harder. Trading on the high time frames and ignoring all the chop and "B.S" that day-traders strain to dish out with is really how you trade smarter. If you wishing much breeding and instruction along how to switch "smarter" on the higher prison term frames, checkout my Forex trading course and members community for more information.

Good trading, Nial Fuller

I WOULD LOVE TO Get wind YOUR THOUGHTS, Delight Entrust A COMMENT BELOW :)

Any questions or feedback? Contact me here.

Source: https://www.learntotradethemarket.com/forex-articles/why-i-hate-day-trading

Posted by: smithnighty.blogspot.com

0 Response to "Why I 'Seriously' Hate Day Trading - smithnighty"

Post a Comment