Forex Scalping 1 Minute Chart

New and inexperienced traders are continually searching for strategies to improve their trading. In this article, nosotros will take yous through a couple of the best one (one) infinitesimal scalping trading strategies available.

Each of these strategies can be used for stock, commodity, cryptocurrency, equity or forex trading. Nosotros volition have yous through:

- What is scalping

- The strategies variables

- How to enter buy and sell positions

- Where to place stop-losses and take-profits

- The advantages and disadvantages of scalping

What Is Scalping?

Scalping can be divers every bit a trading style where a trader capitalises and profits from small price movements. The goal of scalping is to take equally many modest profits as possible. The trades are usually held for a short period, and the trader executing a scalping strategy will not hold positions overnight.

Scalping requires a very strict exit strategy, as one large loss could eliminate the many small gains yous could obtain.

At present let united states take a wait at how scalping works.

How Scalping Works?

Forex scalping is a trading manner used by forex traders to buy or sell a currency pair so hold information technology for a short menstruum of time in an attempt to make a profit. While scalping attempts to capture small gains, such as 5 to twenty pips per merchandise, the profit on these trades can exist magnified by increasing the position size.

The main premises of scalping are:

- Lessened exposure limits take chances: A brief exposure to the market diminishes the probability of running into an adverse event.

- Smaller moves are easier to obtain: A bigger imbalance of supply and demand is needed to warrant bigger price changes. For example, it is easier for a stock to brand a $0.01 move than it is to make a $ane move.

- Smaller moves are more frequent than larger ones: Even during relatively repose markets, there are many small movements a scalper can exploit.

To empathise scalping further, let united states of america take a look at ane-minute scalping strategy variables.

Scalping Strategy 1

This 1 minute scalping strategy is actually easy to learn and tin can be extremely assisting if used correctly.

So, what do you lot need to get started with this strategy?

- Asset: You ideally want to be trading an asset that is currently trending

- Time frame: Your chart should be set to a i-infinitesimal time frame

- Indicators: You'll need to use tStochastic 5, 3, 3 and 50 EMA/100 EMA

- Sessions: Trade in the highly volatile New York and London trading sessions

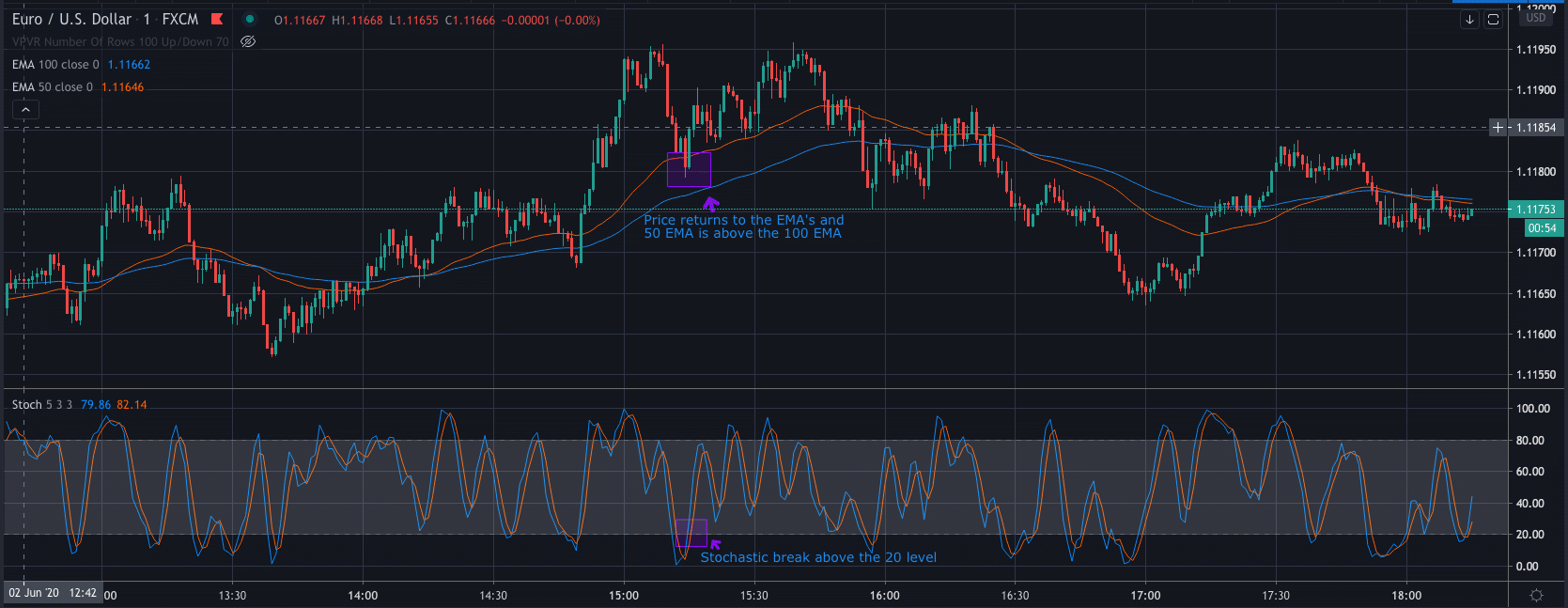

How To Enter A Long Position

Allow's focus on how to enter a long position on the strategy. A purchase position in scalping strategy will need to meet the post-obit criteria:

- To enter a buy position, we first need to wait until the 50 EMA (Exponential Moving Average) is above the 100 EMA.

- Secondly, we need to wait for the toll action to return to the EMA's.

- Finally, the Stochastic Oscillator must break in a higher place the 20 level.

If all iii of these accept occurred, there is now an opportunity to open a purchase order (long position), fantastic!

How To Enter A Short Position

To enter a curt position and sell, you will need the following to happen:

- The l EMA needs to be under the 100 EMA.

- Like to the buy entry, yous should expect for the price to achieve the EMAs.

- The Stochastic Oscillator must then break below the 80 level earlier you open your sell order.

Stop-Loss & Take-Profit Levels

The SL and TP levels for this strategy are set out below:

- Take-turn a profit: The platonic take-turn a profit level for this strategy is viii-12 pips from your entry.

- Stop-loss: The best place for a stop-loss is effectually two to three pips under or above the about contempo swing level.

Click here to practice this strategy in a gratis demo account

The All-time Demo Accounts

eToro: 68% of retail CFD accounts lose money

Accept a await

To master a new trading strategy you need to exercise information technology. Testing out your strategy in a demo account means you can master it without risking your difficult-earned capital. Here we accept picked out for you iii of the best demo accounts effectually.

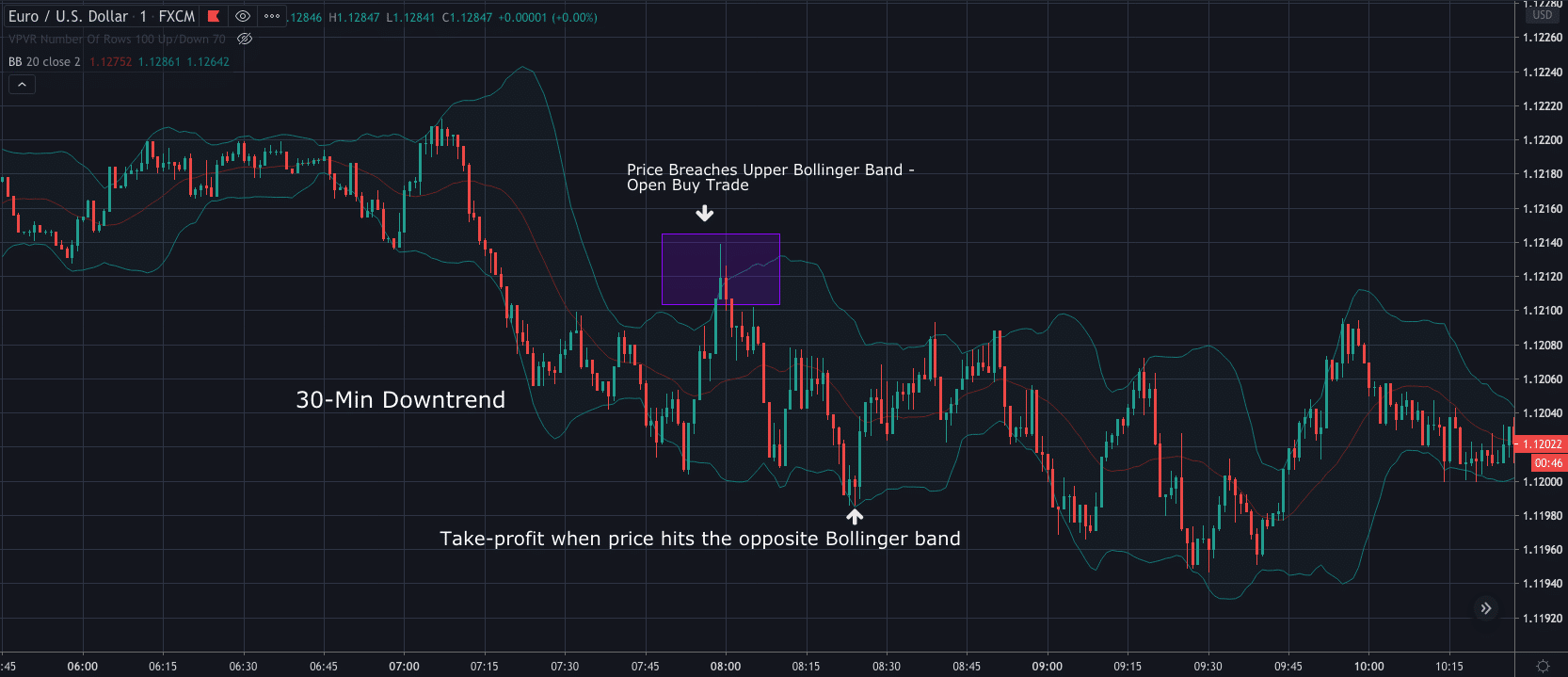

Scalping Strategy ii

The next strategy is easier to understand and follow, so let's get straight into what you will need to go far work:

- Asset: Assets with a lot of volatility ( e.g.currency pair such as the EUR/USD)

- Time frame: For this scalping strategy, you will need to use the thirty-infinitesimal and one infinitesimal chart.

- Indicators: For this strategy, you will only need the Bollinger band fix.

- Sessions: Again, the ideal sessions for this strategy are the New York and London sessions.

How To Enter A Long Or Short Position

To enter a position using this strategy at that place are but two things you demand to be aware of, so I have grouped them into ane.

- Firstly, you lot need to determine the tendency and market conditions using the 30-minute timeframe

- If the price is in an uptrend so y'all enter a buy position once price has breached the lower Bollinger ring.

- If the price is in a downtrend then you enter a sell position once price has breached the upper Bollinger band.

Accept-Profit & Stop-Loss Levels

- Equally you may have seen from the motion-picture show, turn a profit targets should exist where price touches the opposite Bollinger ring.

- Stop-loss levels should be ready 2-three pips above or below the candle that broke the Bollinger band.

Click here to practice this strategy in a free demo business relationship

Of course, with all types of trading plans, in that location are advantages and disadvantages, and one-infinitesimal scalping trading strategies in the forex market are no different.

Advantages of Scalping

- Minimised risk equally the trade is only open up for a short period

- The trading plans allow for more frequent trades as they are smaller in size

- Finally, the strategies provide many potential entries throughout the day

Disadvantages of Scalping

- Novice scalpers might be at risk of losing if they haven't carried out thorough backtesting

- Keeping a positive take chances-to-reward ratio can be challenging

- There is a high risk of many sequent losses

- These strategies require you to dedicate a meaning amount of time in front end of the charts

The Bottom Line

On the surface, scalping strategies appear uncomplicated and more lucrative than swing trading due to the fact that traders take the ability to collect a full day's profit in just a few minutes.

In reality, however, the successful implementation of one-infinitesimal scalping strategies tin create unexpected challenges, and then, information technology should be understood that scalping strategy is only suitable for certain types of trading personalities.

Successful scalpers must show:

- A high level of subject area and

- Be willing to follow the parameters of a trading organisation at all times.

- Scalpers are often required to make important decisions without hesitating

- At the same time, scalpers are flexible and recognise the differences between a merchandise that's working and one that isn't.

In the terminate, a successful scalper is a person that's able to play to the strengths of the market and leave trades at highly favourable moments.

People who read this also viewed:

- Here are our latest trending stories

- Trade Forex with the highly-rated Pepperstone

- Reasons why traders love trading Forex

CFDs are circuitous instruments and come with a high take a chance of losing money quickly due to leverage . 68 % of retail investor accounts lose money when trading CFDs with this provider . You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your coin .

Forex Scalping 1 Minute Chart,

Source: https://www.asktraders.com/learn-to-trade/trading-guide/one-minute-scalping-strategy/

Posted by: smithnighty.blogspot.com

0 Response to "Forex Scalping 1 Minute Chart"

Post a Comment