Where To Learn Forex Trading

What is Forex?

And Why Trade It?

You may not know it, but forex is actually ane of the largest markets in the world, with over $4 trillion in average daily volume transacted.

This hands dwarfs the stock market. All the world's stock markets combined average only near $84 billion per day.

And so, if forex is so big, why have and then few people heard of information technology?

"...y'all have probably already used the forex market before - directly or indirectly."

The simple answer is you have probably used the forex market earlier, either direct or indirectly. Any time you take a trip to another country and exchange money, you simply made a forex trade.

Whenever you lot purchase something in a shop that was made in another country, you just made a forex trade. You paid in your own currency and the manufacturer was paid in a different currency.

People trade currencies all the time, but how can currency be an investment? Hither's a unproblematic example. Imagine that you took a trip from the United states of america to Europe in 2002. For the trip, you changed your U.s.a. dollars into euros. At the end of a trip, you typically would modify any actress euros back into US dollars. But what if you didn't?

In 2002, 1 euro was worth about 90 US cents ($0.90). Say that you lot decided to hold on to 500 euros, and left them sitting in your desk drawer for 5 years. In 2007, you took your euros to the depository financial institution and sold them for a 2007 cost of $ane.40. Since you bought the euros for $0.90 and sold them for $1.40, yous made a $0.50 profit per euro. You would accept made $250 just because you held on to those euros and had bought and sold at the correct time. That'southward a 55% render in 5 years.

The $4 trillion forex market mostly runs on the same idea. Many of the world'southward giant banks, hedge funds, and insurance companies actively merchandise currencies as a way to make money. Since they do so in very large amounts, they record profits and losses in the millions every solar day for the smallest fraction-of-a-cent movements in substitution rates.

Many have non heard of the forex market because the market has historically been largely exclusive to industry professionals. The average person could buy a stock but couldn't merchandise currencies. So information technology remained solely in the hands of the big boys.

Things have inverse

Like the online stock trading revolution of the 1990s, the Internet has brought forex trading within reach of the average person sitting at home.

Thousands of individual traders around the world tin now trade currencies from their living rooms, with cipher but a computer, an Internet connection, and a small-scale trading account.

Yous tin now brand trading and investment decisions to buy and sell British pounds or Japanese yen at any time, day or night (Sunday through Fri). This cursory guide volition evidence you how. But outset, it'south important to know why yous should merchandise forex.

Why Merchandise Forex?

Online forex trading has become very popular in the past decade because it offers traders several advantages.

- Forex never sleeps: Trading goes on all around the world during different countries' business concern hours. You can, therefore, trade major currencies any fourth dimension, 24 hours per mean solar day, v days a week. Since there are no set up commutation hours, it means that there is likewise something happening at almost any time of the day or night.

- Become long or short: Unlike many other financial markets, where it tin be hard to sell short, in that location are no limitations on shorting currencies. If you remember a currency will go up, buy it. If y'all remember it will autumn, sell it. This means there is no such thing every bit a "bear market" in forex–you can brand (or lose) money any time.

- Low Spread cost: Most forex accounts merchandise without a committee and in that location are no expensive substitution fees or information licenses. The cost of entering a trade is the spread betwixt the buy price and the sell toll, which is e'er displayed on your trading screen.

- Unmatched liquidity: Because forex is a $four trillion a day market place, with almost trading concentrated in merely a few currencies, at that place are e'er a lot of people trading. This makes information technology easier to become in to and out of trades at whatsoever fourth dimension, even in big sizes.

- Available leverage: Because of the deep liquidity available in the forex market, y'all tin trade forex with considerable leverage (upwardly to 400:i). This can allow you to take advantage of even the smallest moves in the market. Leverage is a double-edged sword, of course, as information technology can significantly increase your losses as well equally your gains.

- International exposure: As the world becomes more and more global, investors hunt for opportunities anywhere they can. If you desire to take a broad opinion and invest in another state (or sell information technology curt!), forex is an easy way to gain exposure while avoiding vagaries such as foreign securities laws and fiscal statements in other languages.

So, let's start with what a basic forex merchandise looks like

Putting Your Ideas

into Action

A currency'southward value will fluctuate depending on its supply and demand , just like anything else.

Currencies merchandise on an open market, just similar stocks, bonds, computers, cars, and many other appurtenances and services. A currency's value volition fluctuate depending on its supply and demand, merely like annihilation else. If something increases supply or lowers demand for a currency, that currency will autumn. For case, when Hellenic republic threatened to default on its debt, information technology threatened the being of the euro, and investors around the earth rushed to sell euros.

With a sudden dramatic rise in the number of euros for sale and a definite lack of demand for them, the euro dropped precipitously against the U.s.a. dollar and other currencies.

The best thing about forex is that you tin can buy or sell at any time and in whatever order. And so, if yous think the eurozone is going to break apart, you lot can sell the euro and purchase the dollar. If you think the Federal Reserve is printing besides much money, you can sell the dollar and buy the euro.

The Bulls and the Bears

When looking at the future, many traders will have an stance on where a currency is going. If a trader is optimistic and thinks a currency will rise, he is said to exist "bullish". If the trader is negative and expects a currency to fall, he is said to be "bearish". Every 24-hour interval, the bulls and the bears practise battle and the price moves every bit ane or the other gets the upper mitt.

Our job as forex traders is to look at the currencies available to united states of america and to buy the strongest while selling the weakest. So, if afterwards reading the news you lot became surly of euros and bullish of US dollars, you could trade that stance by selling euros and buying US dollars.

Reading a Quote and Making a Trade

Because you are always comparing one currency to another, forex is quoted in pairs. This may seem confusing at offset, but information technology is actually pretty straightforward. Below is an instance of a EUR/USD quote. It shows yous how much one euro (EUR) is worth in United states dollars (USD).

If you, instead, wanted to wait at the euro in terms of the Japanese yen (JPY), you would expect at the EUR/JPY charge per unit. If you wanted to see the value of a US dollar in Canadian dollars (CAD), you lot would look at the USD/CAD.

The first currency in a currency pair is the "base currency"; the second currency is the "counter currency". When you purchase or sell a currency pair, you are performing that action on the base currency. So, if you are bearish of euros, you could sell EUR/USD. Now, when selling EUR/USD, yous are not merely selling euros, only are ownership US dollars. If y'all are more than bullish on the Japanese yen than y'all are on the United states dollar, you could sell the EUR/JPY instead. Information technology'due south all up to you lot.

Let'due south say that you sell EUR/USD at 1.4022. If the EUR/USD falls, that ways the euro is getting weaker and the United states of america dollar is getting stronger. Say the EUR/USD falls to one.3522. In that example, you would have a profit. If it rose to 1.4522, you lot would have a loss. So simply remember: if you sell a pair, down is good; if you buy the pair, up is practiced.

BUY EUR/USD at 1.4022

Down = Loss Up = Profit

SELL EUR/USD at 1.4022

Downwards = Profit Up = Loss

But I don't take any euros. How can I sell them?

You can buy or sell annihilation you lot see active on your trading station, fifty-fifty if you don't accept any of that currency. When trading forex, you are speculating on the modify in rates. You lot do this past borrowing the euros. This is standard for most forex traders. This likewise allows you access to leverage, which can increment your profits and your losses.

So, permit's look at the example again. When you sell EUR/USD, you borrow 1,000 euros and sell them to someone else in the market, earning the equivalent in Us dollars. Say you did this while the EUR/USD is at one.4022. In that case, you lot borrowed one,000 euros, sold them for $1,402.20, and held on to those United states dollars.

Two weeks subsequently, you sold those US dollars when the rate was i.3522. Since the EUR/USD price has fallen, you go more euros dorsum at the end than you borrowed. So, you render the 1,000 euros you borrowed, and the remaining €36.98 is your profit to keep. If the price had risen to i.4522 instead, that €36.98 would instead be a loss. Your trading station will do the math for yous and apply the profit or loss directly to your account.

SO REMEMBER:

Buy currencies that are going up. Sell currencies that are going down.

Find the best pair to practice that with.

Pips, Turn a profit, Leverage, and Loss

Over the years, professional person forex traders have come upward with some autograph to make forex trading easier so yous can quickly make decisions nigh your trading without needing to have out a calculator every fourth dimension.

What is a "Pip"?

A pip is the unit you count turn a profit or loss in. Most currency pairs, except Japanese yen pairs, are quoted to four decimal places. This fourth spot later on the decimal point (at ane 100th of a cent) is typically what 1 watches to count "pips". Every point that place in the quote moves is 1 pip of motion. For case, if the EUR/USD rises from 1.4022 to one.4027, the EUR/USD has risen 5 pips.

"Stock indices take 'points', futures have 'ticks', forex has 'pips'."

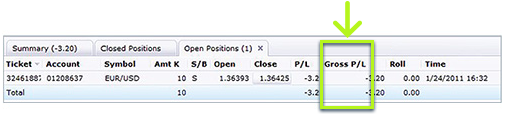

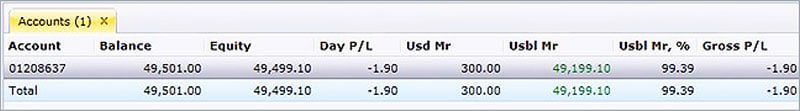

The monetary value of a pip can vary according to the size of your trade and the currency you are trading. FXCM demo accounts typically merchandise in increments or "lots" of x,000. A pip in a standard demo account in EUR/USD is worth $1.00 per lot. If you lot were trading 3 lots, yous would accept 3 pips of turn a profit or loss per pip the EUR/USD moves, and, therefore, $three.00 of profit or loss.

Some currency pairs will have different pip values.

FOR Instance: The EUR/JPY pips are valued in Japanese yen. USD/CAD pips are in Canadian dollars, and and then on. Once over again, your trading station makes information technology all easier by doing the math for you.

How leverage works

As mentioned before, all trades are executed using borrowed coin. This allows you to take advantage of leverage. Leverage 200:ane for major currency pairs allows you to trade with $x,000 in the market by setting bated merely effectually $50 as a security deposit. This means that you tin can take advantage of even the smallest movements in currencies past controlling more coin in the marketplace than you have in your account.

While leverage can exist advantageous in increasing your profits, information technology can also significantly increase your losses when trading, so it should be used with caution. Start trading in small-scale sizes so that you don't have on too much risk.

Leverage is a double-edged sword.

"Like with profit and loss, the trading station keeps track of margin for you. "

Used Margin (Usd Mr) is how much money you have gear up aside to secure your open up trades. Usable Margin (Usbl Mr) is coin left in your account to open new trades or to absorb losses. E'er make sure that yous take plenty of usable margin, otherwise you may get a margin call. If your usable margin gets low, you should close some trades or deposit money into your account.

How to Develop a Strategy

And so, yous at present know what forex traders practise all day ( and all night! ). Seems pretty simple, right? Purchase rising currencies and sell falling ones.

What's Next?

Yous've already taken the kickoff step past learning what forex is. At present information technology's fourth dimension to effort it. Get-go with a demo account. It'due south a free simulation of a real trading account. Information technology has all the functions of a real account (streaming forex prices, pip, P/L, charts, etc.), but the money isn't real. Call back of it as test driving a car.one

Becoming a Knowledgeable Forex Trader

Once on the demo, you'll start to get a feel for how it all works. You can offset buying the currencies you remember will rise and selling the ones you lot think will autumn.

But how exercise you know which currencies will ascension and which will fall?

Over the years, forex traders accept developed several methods for figuring out how far currencies volition go.

- Fundamental Analysis: Since currencies trade in a market, you can wait at supply and need. This is called central assay. Interest rates, economic growth, employment, aggrandizement, and political adventure are all factors that can affect supply and need for currencies.

- Technical Analysis: Price charts tell many stories and most forex traders depend on them in making their trading decisions. Charts can signal out trends and important price points where traders tin enter or exit the market place, if yous know how to read them.

- Coin Direction: An essential part of trading. All traders need to know how to measure their potential risks and rewards and use this to gauge entries, exits, and trade size.

There are several important skills needed in order to go a forex trader. And like all skills, learning them takes a bit of fourth dimension and practice. We take grouped all these needed skills together into an interactive trading course. You tin can acquire how to analyze and trade the market from experienced instructors and traders. They teach using video-ondemand lessons and alive office hours are bachelor and then you can become personal feedback, report on any schedule, and learn at your own pace.

And the best function is information technology'southward free. All you demand to do is show that y'all're serious near getting into the world'due south largest market. Open up a live trading business relationship with FXCM and you will become a real trader with real money. You'll accept unlimited costless access to the course, likewise as tool such as charts, research, and trading signals.

You can apply online at www.fxcm.com/za/open-account/

Where To Learn Forex Trading,

Source: https://www.fxcm.com/za/trading-guides/learn-forex/

Posted by: smithnighty.blogspot.com

0 Response to "Where To Learn Forex Trading"

Post a Comment